The start of a new year has a way of making everything feel possible. Fresh calendars. Fresh goals. Fresh perspective. And for many families, it’s the year they finally say, “This is the year we become homeowners.”

At The Gresham Group, we see this moment every January. Some buyers are just starting to dream. Others have been circling the idea for years. No matter where you are in the process, homeownership is about planning smart, feeling confident, and knowing you have the right people beside you.

Think of this guide as your pre-work — the intentional steps you can take now so that when the right home comes along, you’re ready to move with clarity instead of stress.

Why January is the Best Time to Plan (even if You’re Not Buying Yet)

One of the biggest myths in real estate is that you only need to start thinking once you’re “ready.” In reality, the most successful buyers start months — sometimes a year — before they ever tour a home.

Planning early gives you:

- Time to understand your true buying power

- Flexibility to strengthen your financial position

- Confidence when it’s time to make an offer

- Fewer surprises (and fewer sleepless nights)

And the best part? You don’t have to do this alone. We walk alongside our clients like family — answering questions, connecting you with trusted lenders, and helping you make sense of the process long before it gets serious.

Step 1: Get Clear on Your Why

Before numbers, neighborhoods, or interest rates — start here.

Ask yourself:

- Why do I want to buy this year?

- What does “home” need to support in my life right now?

- Is this a short-term move or a long-term investment?

Your answers shape everything that follows. A first home looks very different from a “forever” home, and clarity here saves time and heartache later.

Step 2: Understand Your Financial Snapshot (without pressure)

You don’t need perfect finances to buy a home — you need honest awareness.

A preferred trusted lender can help you understand:

- What price range makes sense

- How your credit impacts your options

- What monthly payments actually look like

- How much cash you’ll need upfront (and where flexibility exists)

This is a commitment to your situation. And information is power.

What financial habits should buyers focus on most in the months leading up to homeownership?

The biggest habit would be not moving money around and not keeping cash on hand. As we are always under the impression “cash is king” when it comes to lenders, large cash deposits can’t be sourced and unfortunately those cash deposits sometimes can’t be used. When it comes to preparing in buying a home, I would recommend utilizing a high yield savings account or money market account to keep your funds growing there until they are ready to be applied toward the down payment and/or closing cost the next home.

How far in advance should someone talk to a lender before they plan to buy?

You can never prepare too soon. Whether someone is thinking of buying tomorrow or next year, being prepared pays off. Sometimes it’s beneficial to have a soft credit inquiry to identify a baseline just in case the qualifying credit score isn’t where it needs to be, this would give ample time to make needed improvements or put a strategy in place to secure better financing terms in the future. Understanding loan obligations would also prepare a buyer to start setting aside money for a down payment as well and understanding the steps it takes to save for a house.

What’s one common misconception buyers have about credit scores or loan qualification?

The biggest misconception is that you need great credit to buy a house. Whereas a more favorable credit score can generally yield a better interest rate, most lenders can secure financing with a credit score down to a 620, some to a 580, and even a few down to a 500 credit score. It might be smarter to take advantage of loan options that pertain to your credit score level versus trying to improve a credit score while home prices could increase.

How does early pre-planning give buyers an advantage in competitive markets?

Pre-planning is a crucial step as a fully approved file with a lender will outshine that of just a pre approved file. I personally tend to have my files fully underwritten to then place a close on time guarantee when an offer is submitted making our efforts stand even above that of cash buyers. Pre planning will identify any situations that will need solutions far in advance rather than rushing to get solutions which can lead to a stressful experience.

Step 3: Build a Smart Homeownership Checklist

New Year’s Homeownership Prep Checklist

Financial Readiness

- Review your credit report

- Set a monthly housing budget

- Start or strengthen your savings plan

- Reduce high-interest debt where possible

Lifestyle & Needs

- Identify must-haves vs. nice-to-haves

- Research neighborhoods that fit your lifestyle

- Think about commute, schools, and future plans

Education & Support

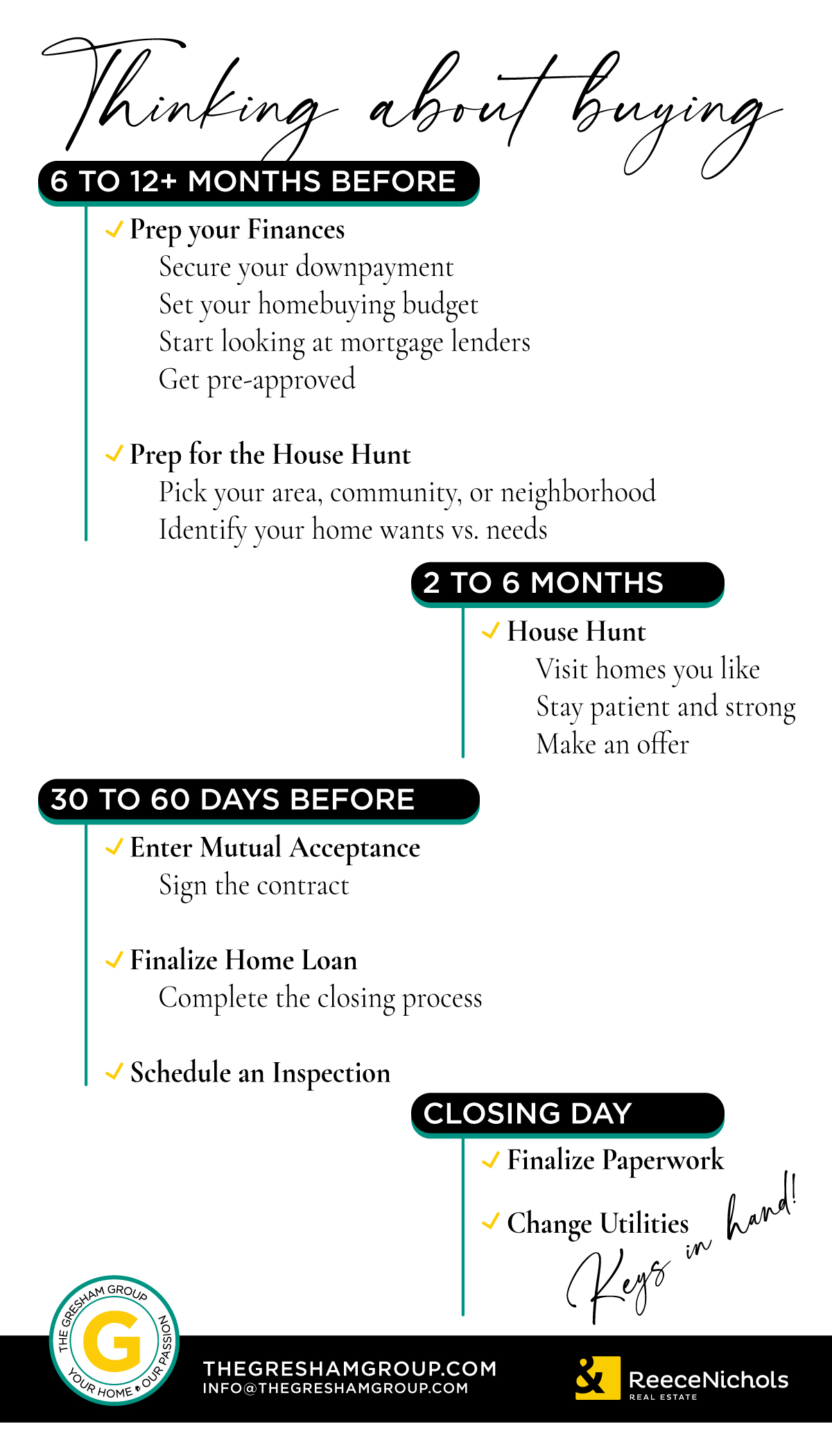

- Learn the home buying process step-by-step

- Connect with a lender for pre-planning

- Choose a real estate team you trust

- Download buyer guides and resources

All of our home buying resources live here: Download Home Buying Assets & Guides

Step 4: Start Conversations Early (they matter more than you think)

The buyers who feel the least stressed are the ones who ask questions early — even the ones they think are “silly.” (Spoiler: there are no silly questions.)

Whether it’s understanding interest rates, timing the market, or figuring out how to compete when the time comes, those conversations now make everything smoother later.

At The Gresham Group, our goal isn’t to rush you into a transaction. It’s to help you feel grounded, educated, and supported — from your very first question to closing day and beyond.

Ready to take the First Step?

If buying a home is on your 2025 vision board, now is the time to prepare — thoughtfully, calmly, and confidently. From pre-approval to closing, we provide expert guidance and support—plus, we charge you absolutely nothing for our services! Our full-time agents bring over two decades of experience to ensure you find the perfect home.

With our knowledge of the Kansas City Metro market and commitment to your success, you’ll feel confident throughout the entire home-buying journey.

And whenever you’re ready, we’re here, just like family. Let’s find your dream home together!