Owning a home is a major financial milestone and an achievement to take pride in. One major reason: the equity you build as a homeowner significantly improves your net worth. With high inflation, the link between owning your home and building your wealth is crucially important.

If you’re looking to increase your financial security, here’s why now is the time to start your journey toward homeownership.

Owning a Home Is a Key Ingredient for Financial Success

A report from the National Association of Realtors (NAR) details several homeownership trends, including a significant gap in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter’s. This difference shows owning a home is a key step in achieving financial success.

Equity Gains Can Substantially Boost a Homeowner’s Net Worth

The net worth gap between owners and renters exists in large part because homeowners build equity. When you own a home, your equity grows as your home appreciates in value and you make monthly mortgage payments. As a renter, you don’t have that same opportunity. A recent article from CNET explains:

“Homeownership is still considered one of the most reliable ways to build wealth. When you make monthly mortgage payments, you’re building equity in your home . . . When you rent, you aren’t investing in your financial future the same way you are when you’re paying off a mortgage.”

Additionally, your home equity grows even more as your home appreciates in value over time. That has a major impact on the wealth you build, as a recent article from Bankrate notes:

“Building home equity can help you increase your wealth over time, . . . A home is one of the only assets that have the potential to appreciate in value as you pay it down.”

Meaning, your mortgage payment acts as a contribution to a savings account that increases in value as your home does. When you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

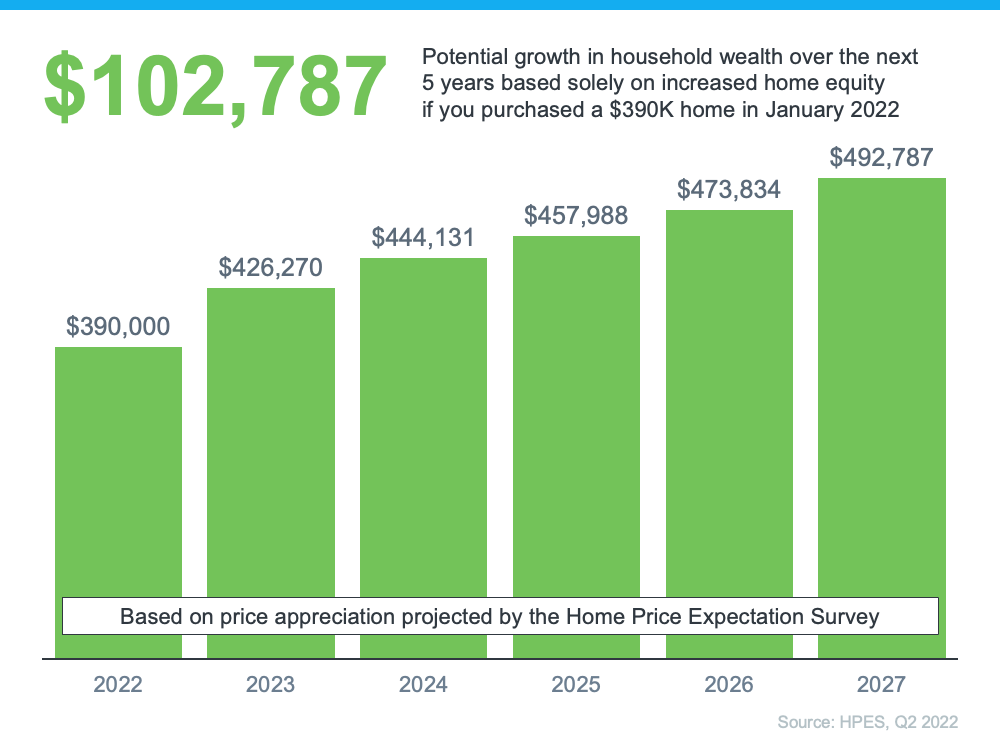

[Green Graph] A recent Home Price Expectation Survey of over one hundred economists, real estate experts, and investment and market strategists, estimates a cumulative appreciation over the next five years.

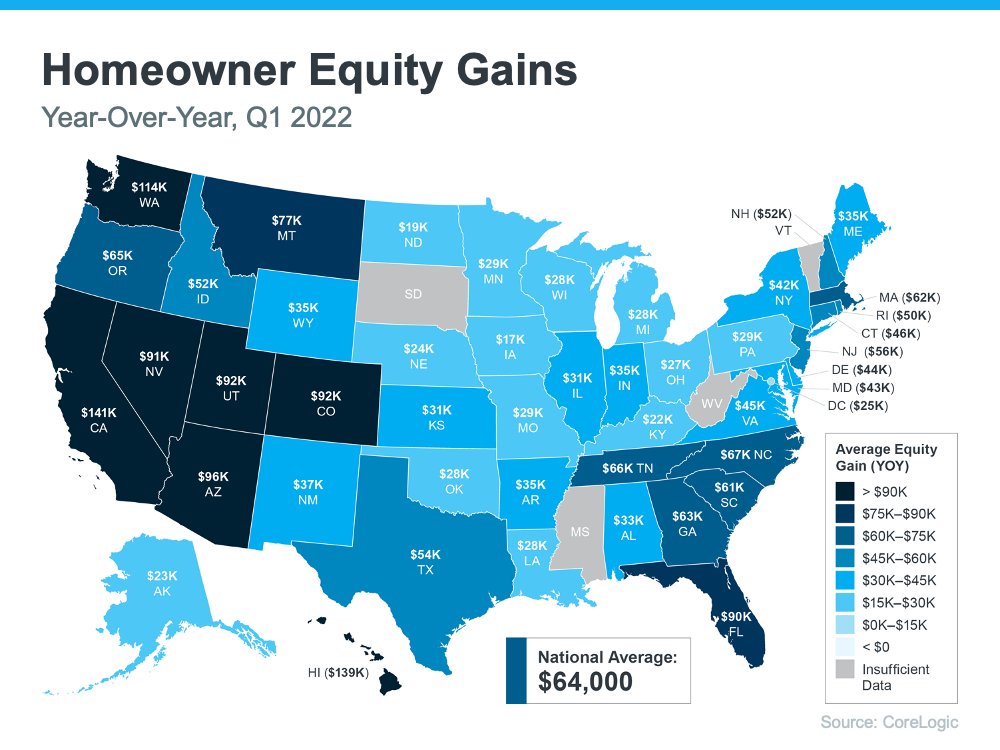

[Blue Map] According to the latest Homeowner Equity Insights from CoreLogic, the average homeowner’s equity has grown by $64,000 over the last 12 months. If you want to know what’s happening in your area, the map breaks down the average year-over-year equity growth for each state using the data from CoreLogic.

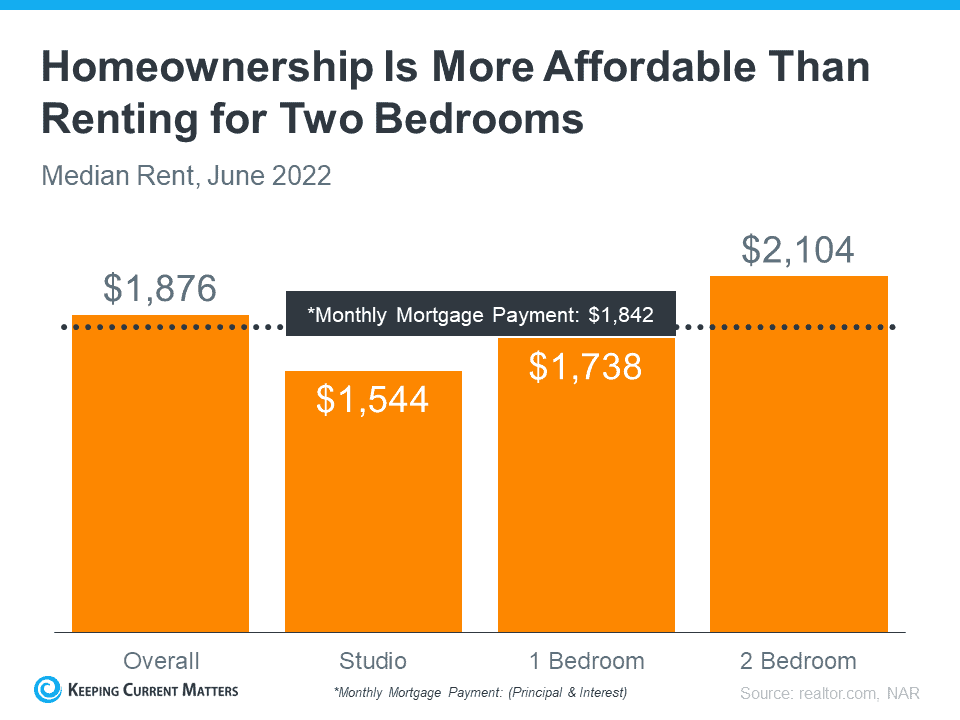

[Orange Graph] According to the latest data from realtor.com and the National Association of Realtors (NAR), it may actually be more affordable to buy than rent, even as home prices rise.

Bottom Line

Owning a home is an important part of building your net worth. If you’re ready to start on your journey to homeownership, let’s connect today. No matter where you’re at in your homeownership journey, the best way to make sure you’re set up for success is to work with a real estate professional.

For local market tips, expert advice, and to begin the buying or selling process, get in touch with our team.

Our free eGuide will answer many of your questions and things you didn’t even know you should consider when buying a home.

Search homes for sale in your selected area(s). Save your searches and favorites. View the newest listings as they come on the market.