Buying a home is likely the largest financial transaction of your lifetime, yet many buyers enter negotiations unprepared and make costly mistakes that can cost them thousands of dollars or even their dream home. With 48% of buyers wishing they had negotiated more with the seller and 79% of buyers compromising on at least one priority, it’s clear that most home buyers aren’t maximizing their negotiation potential.

The good news? Most negotiation mistakes are entirely preventable with the right knowledge and strategy. Whether you’re a first-time buyer or looking to upgrade, understanding these common pitfalls can save you significant money and help you secure better terms on your home purchase.

The Hidden Cost of Poor Negotiation

Real estate negotiations aren’t just about the purchase price. The average closing costs typically range from 2% to 5% of the home’s purchase price, meaning on a $300,000 home, you could face $6,000 to $15,000 in additional costs. Smart negotiation can help you reduce or eliminate many of these expenses, with 24% of home sellers offering some form of concession to their buyer in 2024.

Critical Negotiation Mistakes That Cost Buyers Money

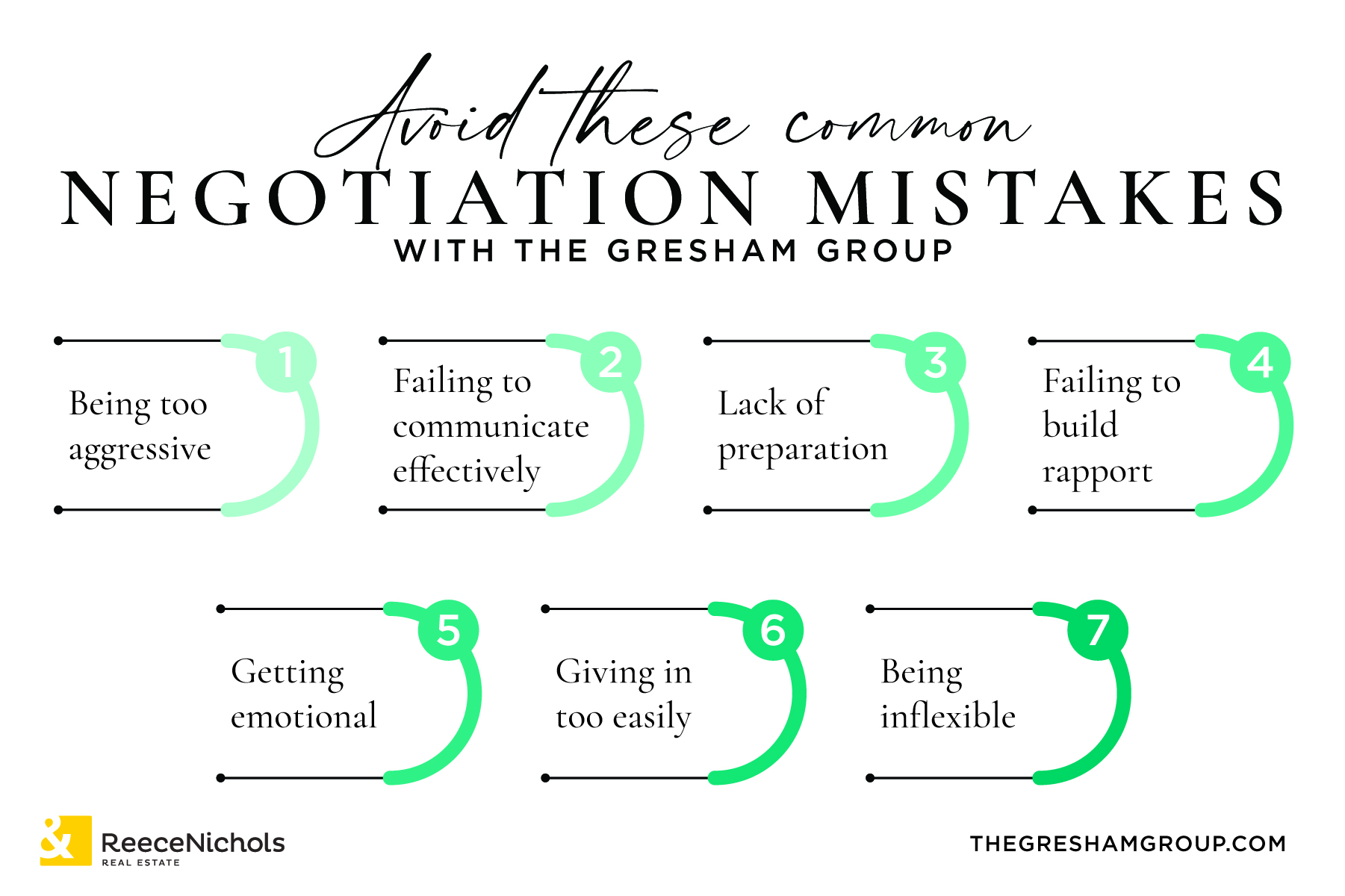

One of the biggest mistakes buyers make is attempting to negotiate without an experienced real estate agent. Real estate agents are experts in your local housing market and can separate emotions from the process while advocating for your best interests. Working with a qualified buyer’s agent who understands your local market is essential for success.

Many buyers also come in with offers well below asking price without comparable sales data to back it up. Instead of focusing solely on the asking price, successful buyers base their negotiations on market value by researching recent comparable sales and using this data to support their offers.

When you make an offer without proof of funding, you’re likely to get passed over for other buyers. Getting pre-approved for a mortgage before house hunting is crucial, as a preapproval letter confirms the mortgage amount you qualify for and shows sellers you’re serious.

Buyers often use the same strategy regardless of market conditions, which is costly. Smart buyers adjust their approach based on whether it’s a buyer’s or seller’s market. In competitive markets, you may need to offer closer to asking price, while buyers markets provide more negotiating room.

Communication mistakes can be equally costly. All conversations should go through your real estate agent, who knows how to phrase requests without jeopardizing your interests. Never contact sellers directly, as this can reveal your negotiation position or create misunderstandings.

Finally, emotion is a weakness at the negotiating table. Buyers who fall in love with a property lose objectivity, leading to poor decisions. Going into the process prepared to walk away from any home helps you negotiate effectively and stay within budget.

Smart Negotiation Strategies That Work

The adage in real estate is location, location, location. When it comes to negotiation, it is data, data, data. Successful negotiations are backed by solid market research and comparable sales data. The more information you have about recent sales, market trends, and property conditions, the stronger your negotiating position becomes.

Understanding the seller’s motivation can dramatically improve your negotiating success. The more you know about a seller, the more effectively you can negotiate. Are they relocating for work? Downsizing? Going through a divorce? Understanding their timeline and motivation helps you craft a more compelling offer that addresses their specific needs and concerns.

Sellers often resist lowering their sale price but may be willing to negotiate in other ways. Sometimes offering flexibility on closing dates or waiving minor contingencies can be more valuable to a seller than a higher price. These non-price concessions can create win-win situations where both parties feel they’re getting value.

Knowing when to walk away is perhaps the most powerful negotiation tool you have. Don’t be afraid to walk away if negotiations aren’t progressing favorably. In negotiations, the one with the power is the one who will walk away. Having other options gives you negotiating strength and prevents you from making emotional decisions that could cost you money.

The Power of Professional Guidance

Many new agents make the mistake of starting every negotiation as if they were going into battle. Not only will this annoy the agent on the other side of the deal, with whom you will likely need to work again, but it can actually hurt your client’s interests as well. Working with an experienced agent from The Gresham Group means having a professional who understands that negotiations should focus on solutions instead of turning everything into an adversarial crisis.

Professional representation becomes even more critical when you consider that negotiations involve complex legal terminology and time-sensitive deadlines. Real estate professionals understand the nuances of contract language and can spot potential issues before they become problems. They also have established relationships with other agents, which can facilitate smoother negotiations and better outcomes for their clients.

Making Your Offer Competitive

In today’s market, especially with all-cash home sales comprising 26% of home transactions in 2024, financed buyers need every advantage possible. A well-crafted offer that demonstrates your seriousness and financial capability can make the difference in competitive situations. This means having all your financial documentation ready, being flexible on terms that matter to the seller, and presenting a clean, professional offer package.

Every seller has memories of their home, and they want to see their home go to people who will take good care of it. You may want to include a personal letter with your offer because of this emotional attachment. Including details about why you like the seller’s property, some of your favorite features, and how you plan to use the home can create an emotional connection that transcends price considerations.

Negotiating Closing Costs and Fees

Closing costs typically average 3% – 6% of the total loan amount, but these costs are often negotiable. You can ask the seller to pay or chip in on some expenses if you want to buy a home but you’re having trouble covering closing costs. The seller may agree in order to close the sale faster, particularly if they’re motivated to move quickly or if the market favors buyers.

Understanding which closing costs are negotiable and which are fixed can help you focus your negotiation efforts effectively. Some costs, like loan origination fees, may be negotiable with your lender, while others, like title insurance or recording fees, are typically set by third parties.

First time home buyers need to be educated and aware of closing costs. Make sure that they keep these in mind when they are looking at their budget.

Kelley Gatlin

First-time home buyers get caught up in small cosmetic issues. It’s important to focus on what really matters.They may also lean on outdated advice, when trusting an experienced realtor can make all the difference.

Afton Kateusz

Communication between realtor, lender, and buyer needs to be transparent. Be honest, share your goals and non-negotiables, and never assume because the better your realtor understands your needs, the better they can negotiate on your behalf.

Josefina Campos

One of the biggest mistakes first-time buyers make is shop for homes before getting pre-approved. A low offer in a competitive market can also backfire. Pre-approval helps you understand your budget and strengthens your offer when it counts.

Paul Gessler

The Bottom Line: Preparation Pays off for Negotiation

Real estate negotiation success comes down to preparation, market knowledge, and having the right professional representation. Lack of preparation is one of the most common negotiation mistakes, leading to missed opportunities and unnecessary expenses. The most successful home buyers spend time understanding the market, getting their finances in order, and working with experienced professionals who can guide them through the process.

We understand that buying a home is both a financial investment and an emotional journey. Our experienced agents combine market expertise with proven negotiation strategies to help our clients avoid costly mistakes and secure the best possible deals. We believe that education and preparation are the keys to successful negotiations, which is why we take the time to ensure our clients understand the process and feel confident in their decisions.

Don’t become part of the statistics of buyers who wish they had negotiated more effectively. Contact The Gresham Group today for a consultation. Our experienced agents will help you navigate the negotiation process with confidence and secure the best possible deal on your next home purchase.